Manny Otiko | California Black Media

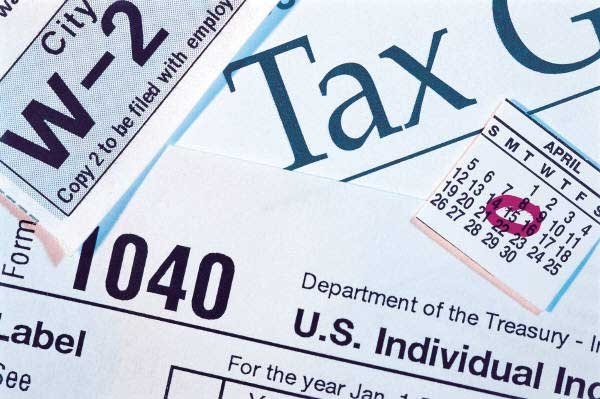

The federal government has moved the tax filing deadline to May for taxpayers this year.

That is just one of the few adjustments the Internal Revenue Service says it has made this year responding to the financial hardships many Americans are facing due to the coronavirus pandemic.

Safety is also a concern.

“Our focus as the pandemic continues is to help taxpayers and the tax industry in a way that ensures the safety of our employees and the taxpayers in the communities we serve,” said Ken Corbin, commissioner at the IRS Wage and Investment Division. “That’s one reason we extended the due date for individuals to May 17, 2021.

The extension only applies to individuals and not filers like corporations – or people who are making estimated payments. For those filers, the IRS says, the April 15 deadline remains.

Corbin was participating in a news briefing Ethnic Media Services organized that focused on IRS rule changes for 2020 tax filers, including how some provisions in the American Rescue Plan will affect Americans’ taxes this year. Susan Simon, director, Customer Assistance, Relationships and Education, Wage and Investment Division, Internal Revenue Service also

attended the briefing and shared information about some adjustments the agency has made this year.

Simon encouraged 2020 taxpayers to file electronically. That way, she explained, there are fewer mistakes, filers don’t have to risk their health by going into a brick-and-mortar offices to meet with tax preparers, and the agency can process their returns much faster.

“The average return comes back in 21 days if you filed electronically,” she said. “It’s six weeks by paper.”

This year, the IRS has some good news for parents. Thanks to the American Rescue Plan, the federal government has increased the amount of the child tax credit. Families with children will get a credit of $2,000 per child filed as a dependent. Parents will also be able to add children born this year as beneficiaries online via IRS.gov.

Another provision in the American Rescue Plan will benefit people who were unemployed during 2020. The agency says up to $10,200 in unemployment insurance paid them last year will not be taxed. For couples, that number is $20,400. People who filed their income taxes before the U.S. Congress approved the law and President Joe Biden signed it into law, will get the money they’ve already paid the feds in a refund beginning in May.

Simon said taxpayers should be aware of some common tax scams and avoid them. One easy way is to use a Personal Identification Number, commonly called a PIN for an added layer of security. She said the IRS has documented several cases of scammers fraudulently filing taxes on behalf of other people using their social security numbers.

Another popular scam, she says, targets college students with phone calls — or anyone with an email that ends in “edu.” The perpetrators threaten those people via calls or emails – often saying they have broken laws. Then, they request tax payments from them.

But Simon said the IRS will never ask for your information, request you make an online payment or threaten you with arrest. The first contact with delinquent taxpayers is always by mail, she said.

“We’re not going to call someone unless we’ve sent a series of bills,” said Simon.

As of April 2, the IRS had received 85 million 2020 individual tax returns and issued over 56 million refunds totaling almost $164 billion.

To make filing online easy for 2020 taxpayers, the IRS is providing a number of digital tax preparation options, including a mobile app called IRS2GO.

“We also have a partner program called ‘text counseling for the elderly.’ It helps with electronic filing by text,” said Simon.

The IRS is also adapting to America’s increasingly multilingual society. The agency now prints filing forms in different languages. According to Simon, IRS forms are available in 20 different languages including English, Russian, Spanish, Urdu and two forms of Chinese, Tagalog and Arabic.

“That covers the most commonly used languages in the U.S.” she said.

Last week, the IRS also announced new guidance under the Taxpayer Certainty and Disaster Relief Act of 2020 that was signed into law by President Trump last year. The new provision would allow businesses to temporarily make a 100 % tax deduction for food and beverages from restaurants, beginning Jan. 1, 2021. It will run through Dec. 31, 2022.

For more information, visit irs.gov.